Selling Commission: Yes, we know, horrific isn’t it that you must also pay a hefty commission when exiting? Our calculator lets you account for this, so you know your absolute return from any given position.So, our calculator allows you to calculate your Loss in the worst-case scenario. This is a safety measure where if it hits this price, you will sell your stock, the minimum value you would let the stock price hit before you exit the position. Stop Loss: This is the selling price you would sell in a worst-case scenario.Theres still plenty of risk involved, even when computers do all the work. If you think that the concept of automated stock trading is a relatively new one, you are completely wrong. Selling price/ Target price: the price you are planning for your stock. But automated trading doesnt guarantee automatic profits.Position size: Quantity of stocks or value of the initial investment.Depending on your broker, this could be a Flat Fee or a percentage, and we offer the flexibility for you to pick either.

Stock profit calculator automated how to#

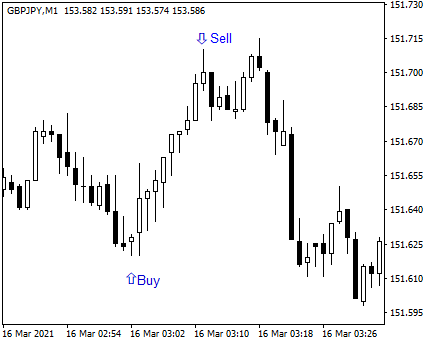

In a newbie term all it’s doing is measuring how much an asset goes up and down using maths How to read and use the Average True Range (ATR) The simplest way to describe the Average True Range ATR calculation is to measure market volatility. Investment calculator Enter your initial investment, any planned additional contribution, your overall.

You can hold investments in a Stocks and Shares ISA and a General Investment Account. Purchase price/Stock price – This is the price at which you have bought or are planning to buy the stock. To help such investors we have designed this stock profit/loss calculator that gives you accurate results in seconds. However, UK income tax and Capital Gains Tax are potentially payable. This is calculated by dividing the gross profit by the gross loss: 149,020 ÷ 75,215 1.98 This is a reasonable profit factor and signifies that this particular system produces a profit.

0 kommentar(er)

0 kommentar(er)